Let me describe this using the perspective of me, a normal and simple guy living in Singapore.

Being in my mid-twenties and having recently graduated from Nanyang Technological University, I start to imagine the kind of life I want to lead. The quality of life I want to have. I start on the path of building a career. I also begin to search for a woman, someone I have chemistry with, to build this quality life together. Gradually I find one, and she is someone I am willing to cherish and to hold, for better or worse, till death do us part. I propose to this woman (assumed that the answer is ‘Yes!!’), and we go through a gate crash (ok, only my brothers and I), a wedding ceremony and a wedding dinner.

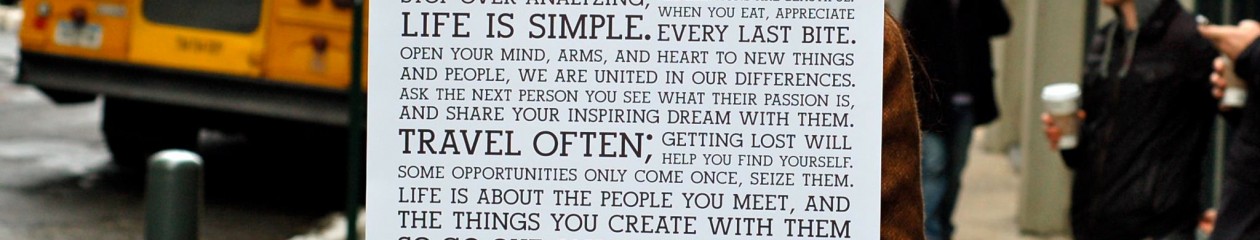

Then we apply for a house and start to pay our housing installments using money from CPF. Life in Singapore is hard work. Time to time, we may want to relax and chill in a nice café, or ghetto bar, or watch musicals. We would also want to visit interesting places overseas, to experience the cultures and life of people in other countries. Sometime later after some magic in the bedroom, a stork carries a baby into the house. This baby goes through primary school, teenage adolescent, university, and gradually becomes an adult. Suddenly, we find that we are approaching old age, and it’s time to retire. Thankfully, there is money from CPF Life. We leave our careers, and holding hands, take a walk along the beach and reminisce about the life that has just flashed past.

A simple life has been described, one that is normal, and probably what Singaporeans will experience. In this simple story, the couple has to understand the costs associated with a wedding, housing, living expenses, relaxation, raising a child, seeing the child through university, retirement, as they will have to finance them.

The couple may also want to know about how inflation affects these costs, how CPF plays a useful part in their financial plan, and how money instruments such as savings plans, stocks, funds, REITs can play a part in making the financial plan better, and their money work harder.

The exercise of planning our finances is not to frighten us about the future ahead. It is to allow us to understand the costs associated with living in Singapore, and how various systems such as CPF and money instruments such as savings plans can help to make the quality of our lives better.

Planning our finances helps to give us some assurance about our life ahead.